Despite the weakening of the gold market during last year, the demand for gold in Asia mainly in China and India strengthened during 2013. But does Asia still play an important role in determining the price of gold? Also, is the strong demand for the yellow metal in Asia enough to pull back up the price of gold?

The price of gold is currently trading around $1,300. In comparison, back in early April 2013, gold was close to $1,600 — this represents a 19% drop. The plunge in the price of gold was mostly attributed to the decline in demand for gold as an investment. Leading gold ETFs such as SPDR Gold (NYSEMKT: GLD) and iShares Gold Trust (NYSEMKT:IAU) recorded sharp falls in their gold hoards during last year as fewer people held on to these investments. Even the 8% gain in the price of gold since the beginning of the year wasn’t enough to significantly increase the demand for these ETFs; case in point, during 2014 and up to date, SPDR Gold’s hoards slipped by 0.3% to reach 798 tonnes; iShares Gold Trust’s gold holdings only slightly rose by 1.2% to reach 164 tonnes.

In Asia the demand for gold continued to rise mainly in jewelry and in coins and bars. China and India led the way as they are considered the largest importers of gold worldwide. According to the latest World Gold Council’s report, in China, the total demand for gold rose by 32% during 2013, year over year; India’s gold consumption grew by 13% last year. Due to the staggering rise in demand for gold in China, it passed India as the world largest consumer of gold with over 1,120 tonnes of gold in 2013. This year, however, the growing demand for gold in China and India might slow down especially if China’s economic growth slows down (e.g. in the first quarter of 2014, China’s GDP grew by only 7.4%; back in the last quarter of 2013, its GDP rose by 7.7%), and India’s rupee keeps depreciating against the US dollar.

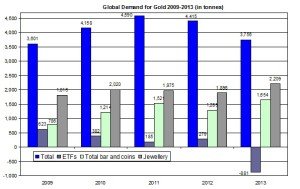

Despite the sharp rise in demand for physical gold, the global demand for gold dropped to its lowest level since 2009.

The chart below shows the changes in the global demand for gold in recent years. It also shows three main sub divisions: ETFs, bars, and coins and jewelry.

Source: World Gold Council’s site

As you can see, the sharp fall in the demand for gold in ETFs dragged down the total demand for gold to 3,754 tonnes. This means, the sharp rise in demand for gold in Asia was offset by the gold sales in ETFs. If ETFs keep selling off their gold hoards, this trend could offset any additional rise in demand for gold in Asia. Therefore, if Asia keeps increasing its demand for gold in the coming years, the selloffs of gold hoards in ETFs could offset this trend and drag further down the price of gold.

Foolish bottom line

The ongoing growing demand for gold in Asia will remain an important part in affecting the price of gold. But the demand for gold as an investment will play an important role in determining the direction of gold. If ETFs keep selling their gold holdings, the global demand isn’t likely to grow and the price of gold will resume its downward trend.

For further reading:

- Will Gold Recover from its Recent Fall?

- What Could Impede This Gold Company?

- Will The Gold Market Continue to Cool Down?

Disclaimer: The author holds no positions in stocks mentioned and does not plan to initiate positions within 120 hours of the posting of this article. This article is to be used for educational, research and informational purposes only and does not constitute investment advice. There are no guarantees, expressed or implied, of future positive returns in regards to the subject matter contained herein. Understand the risks inherent in investing before making the decision to invest or consult an investment professional for more information. Reasonable due diligence has been performed in regards to the information in this article. However, the author expressly disclaims any liability for accidental omissions of information or errors in fact.